Etsy sales fees: what are they?

Etsy sales fees which are obligatory fall roughly into three categories

- Listing fees of USD 0.20 plus VAT of 21%. Which is effectively 0.20 EUR according to the current exchange rate.

- Transaction fees of 3.5% plus VAT, effectively 4.2%. Calculated on the item net price without shipping costs.

- Etsy Payment processing fees: for the Netherlands: 4% + 0,30 euro.

There are also other, non-obligatory fees, such as promotion, renewal, Etsy Pattern etc.

The situation and the calculations described here apply to a seller based in the Netherlands.

Etsy sales fees: where do you see them?

Etsy is transparent about their fees. You find a lot of answers in the FAQ section (see links above). I already mentioned them in my previous blog, comparing to other platforms such as DaWanda.

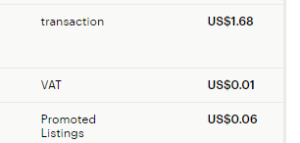

Transaction and listing fees, as well as VAT, are shown in the monthly Etsy bill.

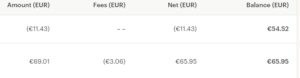

Etsy payment processing fees do not appear on the Etsy bill and make a separate fee in a payment account. You can see these fees in ( ) below. They vary by country and are calculated on the order total (including any shipping and taxes). Etsy Payments processing fees are withheld automatically at the transfer of the funds on the seller’s bank account.

The less visible part: currency conversion rate with a surcharge

If your shop has euro as a preferred shop currency, all listings are priced and sold in that currency. If you sell to a buyer who uses a different currency, Etsy does convert the proceeds. This is not the only case when conversion takes place.The 3.5% transaction fee charged by Etsy is also calculated after it has been converted to United States dollars (USD). In fact, European sellers selling to the US deal with conversion twice. At sale and at the calculation of the sale commission.

When a conversion is required, Etsy applies 2.5% to the current market exchange rate. It means losing this percentage at sale but also when paying transaction fees. However, the latter is a negligible percentage. Applying a lower exchange rate to the sale proceeds means that you get 2.5% less than it would be the case.

So which percentage of the sale income is effectively lost to Etsy sales fees?

Let’s take a listing with a value of EUR 50 and free shipment (for the ease of calculation), sold from the Netherlands to the US and paid via Etsy Payments processing system.

When you list you pay 0.20 EUR (let’s assume that it is a sale from the first time listed and you don’t need to relist the item)

When this item sells you get 50-(4%+0.30 +2.5%) = 50-3.65 = 46.45 EUR transferred to your bank account

At the time your monthly bill falls due you pay 4.2% commission fee which is 2.10 EUR

Your net proceeds from the sale minus cost of sale are thus 44 EUR.

Meaning you lose roughly 12% on this sale transaction.

Can the payment fees be less? For instance when paid by PayPal Payments?

Sure. When the payments run through a different route, the direct costs of sale can be less.

The best situation is when your buyer is in Europe, uses Euro as a currency and pays directly to your bank account. In this case, your net proceeds will be 47 euro which reduces your costs of sale by half.

But this is an ideal situation, especially for international sellers. The buyer is not motivated (even by a discount) to replace the convenience of a direct checkout by a tedious procedure of filling IBAN, BIC and SWIFT codes. Besides, it can cost them money if they are outside EU.

Would PayPal be a better alternative? PayPal fee for each transaction is 2.9% plus $0.30 USD of the amount. PayPal also charges a 2.5% currency conversion fee. On your 50 EUR transaction, it would make 1.45+0.25 = 1.70 EUR as compared to Etsy Payment processing fee of 3.65. The more expensive item you sell the bigger this difference gets.

So yes, PayPal is a 1,1% better payment alternative.

Also when the buyer pays with a credit card a certain percentage is withdrawn by the credit card company. The percentages differ, therefore I did not use them in my calculations.

Leave a Reply